Visa Business credit card

A simple and comfortable non-cash payment.

of company spending and a transparent monthly overview of card use

for ATM, POS terminals and online purchases

with direct debit (8th, 18th or 28th day of the month)

The holders of Visa Business credit card settle their business obligations without cash, and by using the card the company has better overview of the costs.

Payment without physical contact between payment card and POS terminal. The contactless sign is clearly visible on POS terminal. SKB card that enables contactless payment holds the same sign.

Personal identification number (PIN) can be changed on all SKB ATMs.

Visa Business credit card enables non-cash long-distance payment (online purchases, hotel reservation and payment, airplane tickets, rent-a-car).

Cash withdrawal possible at ATMs and SKB outlets or other banks at home and abroad marked with Visa sign.

Safe operating is enabled by chip and PIN number, which you use to confirm a purchase at the point of sale.

Choose also other bank services that will take additional care of safety of your bank operations and enable you better control over spending on card account.

Business card plus insurance is intended for companies and professionals, SKB transaction account holders and users of their business cards.

you need a valid identification document (ID card or passport) and tax number.

Complete the application for change of bank, and we will arrange everything else instead of you.

Your relationship officer will wait for you in the outlet on the agreed upon date and time.

With his help, you will be able to arrange everything quickly and easily.

With mobile and online bank, you can arrange as many as 53 different tasks without visiting the bank.:

With the development of new technologies and the spread of digitalization in all areas of life, various online fraud are also on the rise. Familiarize yourself with the different ways online fraudsters try to get their personal information and your money – it's never too late to protect yourself!

Remember: your bank will never ask you for personal information or login to electronic banking via email, SMS or phone. Do not entrust your data for entering digital channels (mobile or online banking) and Flik Pay application to anyone or enter them on any website except your own electronic devices.

You can use 3-D Secure at those online retailers that allow its use. You can recognise online shops by their logos.

PROCEDURE FOR CONFIRMING ONLINE PAYMENTS IN MY@SKB MOBILE BANKING

You will receive a push message on your mobile phone when you make a payment transaction. When you click on the message, you will be redirected to the MOJ@SKB mobile bank where you will be strongly authenticated, either by biometrics or by entering your PIN number.

If you do not have push messages switched on, you can find the online payment confirmation request in the MOJ@SKB Mobile Bank in the selection menu (Menu-Confirm online payment).

To receive push messages, you must have updated your MOJ@SKB Mobile Bank and have logged in to the Mobile Bank at least once after the update.

In MOJ@SKB Mobile Banking, you will see more detailed information about the transaction on the screen and a button to confirm or decline the transaction.

In case you confirm the transaction by clicking on the "Sign" button and entering the PIN number you use to enter the mobile bank or biometrics, you will receive an authorisation message and once the authorisation is successful, the purchase is successfully finished.

PROCEDURE FOR VALIDATING ONLINE PAYMENTS IN THE REKONO ONEPASS APP

You will receive a push message on your mobile phone when you make a payment transaction. When you click on the message, you will be redirected to the Rekono OnePass app, where you will be asked to enter your PIN number or authenticate with your fingerprint/facial recognition.

In the Rekono OnePas app, you will see more detailed information about the transaction and a button to confirm or decline the transaction.

When you click on the "Confirm Payment" button, your purchase will be completed successfully.

Global Customer Assistance Services (GCAS) are available 24 hours a day worldwide for situations such as: time-delayed card cancellation in the event of loss, theft or misuse, fast retrieval of a replacement card, fast retrieval of cash in emergencies, enquiry services.

Global Customer Assistance Service (GCAS) provides faster cancellation in the event of loss, theft or misuse of your VISA Platinum card. It also allows you to quickly obtain a replacement card and, in an emergency, the cash you need.

Any problems with your VISA Platinum card can be resolved anywhere, anytime with a single call to one of the GCAS toll-free numbers. A global network of service assistance provides communication in several languages. We recommend that you take with you when you travel the freephone helplines for the area you are visiting.

Temporary replacement card

If needed, the system will provide you with a replacement temporary card free of charge within one working day, and you can pick up your card at one of around 1,000 emergency service points worldwide. You can request a replacement card at the same time as reporting the loss or theft of your card by calling the free general helpline.

Urgent cash authorisation

GCAS will also authorise, in agreement with your home bank, an amount of emergency cash, which may be up to five thousand US dollars, to be collected by you in the agreed manner.

Enquiry services

GCAS also provides freephone numbers to answer various questions, such as information on the nearest ATMs where you can withdraw cash with your VISA Platinum card.

Important

The service is free if you make a call from your local network to the number that applies to the country where you are located. Mobile operators or hotel line providers may charge for the call.

A list of freephone numbers with more information is available at (https://www.visaeurope.com/lost-your-card).

If the country you are in is not on the GCAS Freephone Assistance list or you are unable to connect, you can make a collect call from your local network to +1 303-967-1096

Mobile operators usually do not support or charge for the service, which is not the responsibility of the bank or card scheme.

Some POS terminals may still require a PIN number to be entered even for purchases of less than 50 EUR, as the amount limit on the POS terminal depends on the amount set by the international card scheme.

You will also need to enter your PIN number if you have made more than 150 EUR in consecutive contactless purchases.

Example

If your contactless purchase is declined, always try to complete the purchase by inserting the card into the POS terminal.

When you are issued a new card, you must provide your mobile phone number to which your will be receiving one-time authentication passwords in person at an SKB d.d. outlet or via the electronic bank.

One of the main advantages of 3-D Secure is that it can be used on any computer with an Internet connection and a web browser without any additional installation or setup. When making online purchases on public computers, you need to pay special attention to security and privacy, as they are often targeted by cybercriminals who are after your payment card information.

If the one-time password entered is incorrect, the system requests a re-entry. If you enter the password incorrectly more than three times, the transaction is interrupted and the entire process must be repeated.

If the mobile phone number that the Bank has on record for you is incorrect or if the Bank does not have a mobile number on record at all, you should stop the transaction. In this case, you must provide your mobile phone number in person at an SKB outlet or via the electronic bank.

At the online point of sale that allows the use of 3D-Secure, select »Payment card« as the payment method and enter the required card information. After confirming the entered data, you will receive a request to confirm your online purchase on your mobile phone. If you have disabled the receipt of automatic push messages on your mobile phone, look for a confirmation request in MOJ@SKB mobile bank in the menu bar »Confirm online payment«. After confirming the request, the purchase will be completed successfully.

You can use the 3-D Secure service for all your purchases with online retailers that support 3-D Secure. You can easily recognize these retailers by the 3-D Secure logo.

Individual activation of the service is not required, nor is the installation of additional new hardware and software required. All you have to do is make a purchase with a payment point in an online store that supports 3-D Secure and is marked with the Verified by Visa and MasterCard® SecureCode ™ logos.

The 3-D Secure service brings online purchases with cards a higher level of security, as each purchase verifies the authenticity of the cardholder, using two of the three elements that prove that the payer is the real holder of the payment card. It’s a combination of what we have, of what we are and what we know.

The use of the 3-D Secure service is free of charge for all SKB cardholders.

The 3D-Secure service can be used by any SKB Visa and Mastercard card holder.

"Get better transparency of your personal account operations and easy control of your savings, overdrafts and deposits! You can order SMS info easily at any SKB outlet. All you need is a personal ID and a phone number to which you want to receive Info SMS. Make an appointment with your individual relationship officer via SKB TEL by telephone: (01) 471 55 55.

Detailed Info SMS provides notifications about:

Quick Info SMS provides notifications about:

Info SMS includes all notifications by default, but you can choose which ones you wish to receive."

3D-Secure is an international security standard that makes it easy and secure to pay online. It is supported by Visa as Visa Secure and Mastercard as Mastercard ID Check.

Yes. You can change the timing of your direct debit with your individual relationship officer at one of the Bank’s outlets or via SKB NET.

In both cases, a new Personal Identification Number (PIN) for the card must be requested, which you can do at any SKB outlet in person, by fax or by email.

Yes. All SKB card holders can quickly change their Personal Identification Number (PIN) at all SKB ATMs.

3-D Secure is a security standard designed to improve the protection of cardholders when making online card payments, thereby reducing the risk of unauthorised use of cards by third parties.

Benefits of 3-D Secure:

The card holder must immediately report the loss or theft of the card by calling the indicated telephone number or at the nearest SKB outlet. The card holder must also report the theft of his/her card at the nearest police station as soon as possible.

24 hours a day, you can call the tel. no.: (01) 471 50 90 (We recommend that you save the number that you can call in case of loss or unauthorized use of your card).

The card holder must, within 8 days from the date of the report done by phone, confirm the loss or theft of the card in writing at the outlet where he/she has a personal account. At the same time, the card holder can apply for the issue of a new card.

Customers are advised not to keep their Personal Identification Number (PIN) and card together in the same place.

SKB card holders can protect their cards against unauthorized use if lost or stolen, with Card insurance plus. With Card insurance plus, personal items (keys, personal documents, handbag, wallet, mobile phone and tablet) are also insured in case of loss or theft.

Global Customer Assistance Services (GCAS) are available 24/7 around the world in cases such as: canceling a card with a time delay in case of loss, theft or misuse of a card, quick issue of a replacement card, quick cash advance in case of emergency, information services.

Global Customer Assistance Services (GCAS) enable you to swiftly cancel your card in case of loss, theft or misuse of a gold VISA Prestige card. It also allows you to quickly obtain a replacement card and, in an emergency, access to any cash you might need.

If you encounter any problems with your gold VISA Prestige card, you can get assistance anywhere and at any time by simply calling one of the GCAS toll-free telephone numbers. The global network of Global Customer Assistance Services provides multilingual assistance. We recommend that you look up the toll-free assistance numbers for the area you are traveling to in advance.

Temporary replacement card

If needed, the system will provide you with a temporary replacement card free of charge within one business day, and you can pick up your card at one of the thousands of emergency service points around the world. You can request a replacement card when you report your card stolen by calling the toll-free telephone number.

Emergency cash advance

The GCAS, with your parent bank’s authorization, can also approve emergency cash disbursements of up to $ 5,000, which you can collect in a pre-arranged manner.

Information services

The GCAS offer toll-free telephone numbers that you can call if you have any sort of questions, such as information about the location of ATMs, where you can withdraw cash with your gold VISA Prestige card.

Important information

The service is free of charge when you make a call from your local network to a number that is assigned to the country in which you are currently located. Mobile operators or call service providers may charge you for the call service.

A list of toll-free telephone numbers with more detailed information is available at (https://www.visaeurope.com/lost-your-card).

If the country in which you are currently located is not on the GCAS Toll-free Telephone Assistance list, or if you are unable to connect to an existing number, you can make a collect call from the local network at the tel. no.: +1 303-967-1096

Mobile service providers do not typically support the service or will charge you for the service, which is outside of the Bank’s competence area or outside of the Bank’s card scheme.

Contactless payment is a payment without physical contact between a payment card and a POS terminal. The contactless sign is clearly visible on the POS terminal.

Contactless payments - fast, touchless and secure:

Payment up to 50 EUR - contactless and without entering a personal number

Bring the card close to the sign on the POS terminal and wait for an audio and/or light signal. After making the payment, you will take a receipt for payment.

Payment over 50 EUR - contactless and by entering a personal number

Bring the card closer to the sign on the POS terminal, type in your personal number (PIN) and wait for an audio and/or light signal. After making the payment, you will take a receipt for payment.

Important when changing cards:

Security SMS notifies you of any withdrawal of cash at an ATM, any purchase at a POS or any purchase made online or by mobile phone, via SMS. You immediately receive a notification in case of any transaction made in Slovenia or abroad with your credit or debit card.

Advantages:

How do I obtain the Security SMS function?

You can fill out an application for Security SMS via the SKB NET online bank or in person at your nearest SKB outlet. You can choose when you want to receive an SMS notification on the use of your card.

| Service | In Slovenia | Abroad |

|---|---|---|

| ATM withdrawal | every withdrawal | every purchase |

| Purchase via POS | every purchase | every purchase |

| Purchase online/via phone | every purchase | every purchase |

| Purchase cancellation | every purchase | every purchase |

With Security SMS, you receive the following information:

The message also includes key information and a phone number to call when you suspect unauthorized use of your card.

Card insurance plus is intended for adult SKB account holders and all SKB card holders, as well as persons authorized on a personal account opened with SKB.

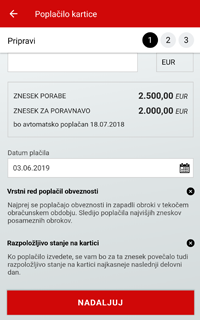

One of the features that are common to all credit cards is the billing period in which the client makes purchases with the card, followed by the automatic payment of the credit card bill for the said billing period on the agreed payment due date (8th, 18th or 28th of the month) or the first following business day. At the end of the billing period (usually 11 days before the agreed payment due date), a statement and (internal) direct debit with the total amount of payments (credit card bill amount) are prepared.

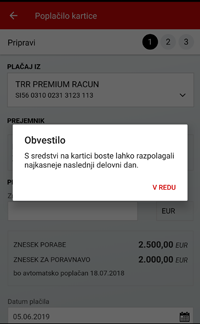

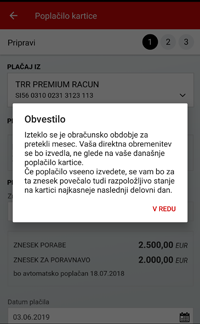

If the client executes an early repayment after the billing period has ended, the following happens:

This does not occur during the billing period, as the statement and direct debit for the amount spent with the credit card have not yet been prepared. An overpayment cannot occur if the client pays only the difference between the spending amount and the credit card bill amount after the end of the billing period.

For more information regarding the Repayment order and the Available balance on the card, click +.