3-D Secure

New way of confirming online

payments for higher security.

Two-factor confirmation of online payments.

Improved protection for cardholders.

Risk reduction of unauthorized use of cards by a third party.

With the PSD2 Directive, the European Banking Authority (EBA) introduces a strong authentication requirement, which requires the use of two out of three elements proving that the payer is the real cardholder of the card used for online payments. It is a combination of:

SKB bank has for persons with an account in the bank, introduced confirmation of online payments in MOJ@SKB mobile bank.

1

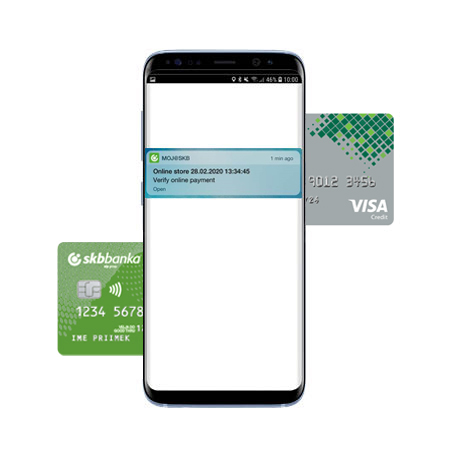

You will receive a push message on your mobile phone when completing a payment transaction. When you click on the message, you will be redirected to MOJ@SKB mobile bank, where you will perform authentication or enter your PIN number.

If you do not have push messages activated, you can find a request for confirmation of online payments in MOJ@SKB mobile bank in the selection menu (Menu-Confirm online payments).

A precondition for receiving push messages is an updated MOJ@SKB mobile bank and at least one login into the mobile bank after the update.

2

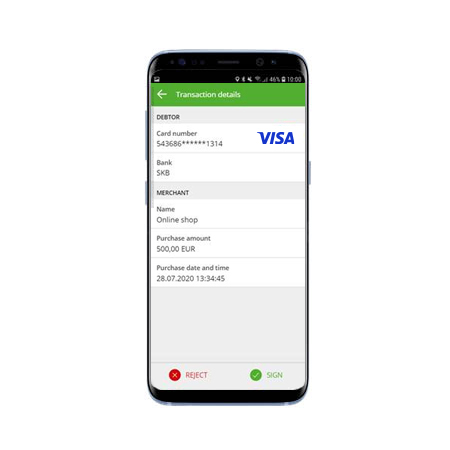

In MOJ@SKB mobile bank, more detailed information about the transaction and a confirmation or rejection button will appear on the screen.

3

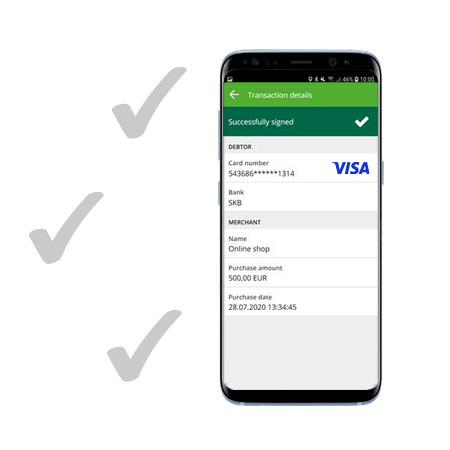

If you confirm the transaction with a click on the button "Sign" and enter your PIN number, you will receive a message about the successfully signed transaction and your purchase will be successfully completed.

Tell us your wishes and arrange everything for obtaining the activation code in the outlet or get the code through SKB NET online bank if you are already an user.

The app supports mobile phones with Android and iOS operating systems.

Quickly and simply activate the app in the outlet or if you already use SKB NET, activate it through the SKB NET online bank with .

If you do not have a smartphone, you can confirm online payments using Rekono services. On the Rekono website, select Control Panel, create an account, and activate 3D-Secure. To activate, it is necessary to set a 4-digit static password, add a bank and specify Rekono SMS OTP.

Rekono OnePass operates at the user level and does not distinguish between physical and legal users. When a payment card holder activates one card at a certain bank, all payment cards at that bank are activated. In practice, this means that when a payment card holder activates Rekono OnePass, he uses it to confirm all online payments, regardless of whether he has a MOJ@SKB mobile bank as a natural person.

You can quickly and easily arrange it by visiting the branch. Make an appointment at a personal banker or through the Contact Center on +386 1 471 55 55.

If you are already an user of the SKB NET online bank, you can activate MOJ@SKB mobile bank within SKB NET.

If you already have MOJ@SKB mobile bank, you do not need to do anything and you are ready for a new way of confirming online payments. We will inform you in advance about the exact introduction of this via SMS. For this purpose check if you have the correct contact information. You can do this via the selection menu in MOJ@SKB mobile bank (Menu-User data). In case the displayed data is incorrect or missing, click '…' at the bottom right and select Edit my data.

The request to confirm the online payment is limited in time to 7 minutes and 30 seconds. If you do not confirm it within this time, the claim will expire and the online payment will not be made, so you will have to repeat the purchase.

The critical vulnerability in the existing confirmation of online payments is one which allows a potential attacker to take control of the user's phone number without the knowledge of the telecommunications operator - such abuses have occurred in the past.